Credit scores are crucial in our financial lives, influencing everything from loan approvals to interest rates. When planning to purchase a car, understanding how your credit score impacts the financing process can save you time and money. This blog post will delve into the key differences between credit score checks done by car dealers and the credit score service provided by Credit Karma. We’ll explore the technical differences between credit scoring models and their relative importance to customers and offer tips to help you improve your credit score for smoother auto financing.

Understanding Credit Scoring Systems

What is a Credit Score?

Credit scoring is a statistical analysis used by lenders to determine the creditworthiness of a person or a small business. Different financial institutions use various scoring models, but the two most common are FICO and VantageScore.

Major Credit Bureaus

Credit scores are calculated based on data from three major credit bureaus: Experian, Equifax, and TransUnion3. Each bureau may have slightly different information, leading to variations in your credit scores.

Key Credit Scoring Models

- FICO Score: Widely used by lenders for making credit decisions. It ranges from 300 to 850, with higher scores indicating better creditworthiness.

- VantageScore: Created as a joint effort by the three major credit bureaus. Like FICO, it also ranges from 300 to 850.

Credit Score Checks by Car Dealers vs. Credit Karma

Car Dealer Credit Checks

When you approach a car dealer for financing, they typically perform a hard inquiry on your credit report. Here’s how it works:

- Hard Inquiry: This type of credit check can temporarily lower your credit score by a few points. Dealers often check scores from multiple credit bureaus to secure the best loan terms.

- Customized Scores: Some dealers use specialized auto industry-specific scoring models that weigh factors differently compared to general-purpose credit scores.

- Impact on Financing: The credit score obtained by the dealer directly influences your interest rate and loan approval chances. Lower scores often result in higher interest rates or even loan denial.

Credit Karma Credit Score Service

Credit Karma provides free access to your credit scores and reports from only two major credit bureaus—TransUnion and Equifax. Here’s what makes it different:

- Soft Inquiry: Checking your credit score on Credit Karma does not affect your credit score as it involves a soft inquiry.

- Educational Tool: Credit Karma helps you monitor your credit health and understand factors affecting your score. This can be particularly useful for planning before you visit a car dealer.

- General Scores: The scores provided are VantageScores and may differ slightly from the scores used by auto lenders.

Importance of Checking Your Credit Score Before Visiting a Car Dealer

Knowing your credit score before visiting a car dealer is crucial for several reasons:

- Negotiation Power: Knowing your score allows you to negotiate better financing terms.

- Loan Preparation: Understanding your score helps you anticipate and address potential financing challenges beforehand.

- Avoid Surprises: Knowing your score can prevent unpleasant surprises or denials at the dealership.

How Car Dealerships Operate with Regards to Credit Score Checks and Auto Financing

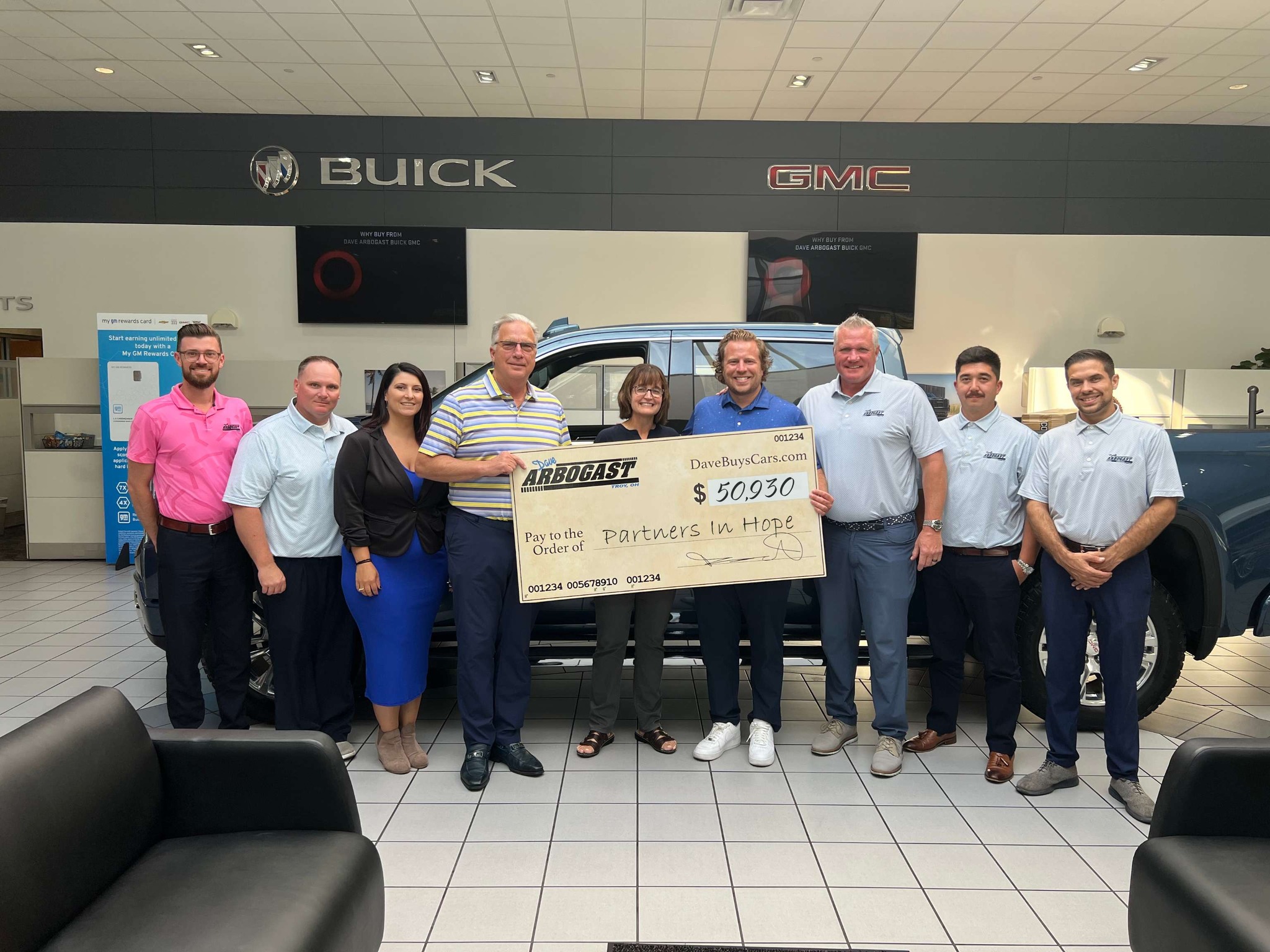

Car dealerships like Dave Says Yes often work with multiple lenders to provide financing options to customers. Our close relationships with some lenders allow us to lend to some who may have been turned down in the past. We will submit your credit application to these lenders, who perform hard inquiries and return offers based on your credit profile. The dealership may present you with several financing options, each with different terms and interest rates based on the credit scores provided by the lenders.

Tips to Improve Your Credit Score for Easier Car Purchases

Tips to Improve Your Credit Score for Easier Car Purchases

- Pay Bills on Time: Consistent, timely payments are among the most significant factors in building good credit.

- Reduce Debt: Lowering your overall debt level can improve your credit utilization ratio, positively impacting your score.

- Check for Errors: Regularly review your credit reports for inaccuracies and dispute any errors.

- Limit Hard Inquiries: Avoid applying for too much new credit quickly, as each application can lead to a hard inquiry.

- Maintain Long-Term Accounts: Older credit accounts contribute positively to your credit history length.

Understanding the differences between credit score checks by car dealers and scores found on Credit Karma can help you navigate the auto financing process with confidence. While Credit Karma provides an overview of your creditworthiness from a credit card company’s perspective, car dealerships consider factors such as income, job tenure, and payment history. Proactively managing your credit score and knowing what to expect from dealership credit checks can help you secure better financing terms and make informed decisions. Remember, improving your credit score takes time, but with persistent effort, you’ll be well-prepared for your next car purchase with Dave Says Yes.